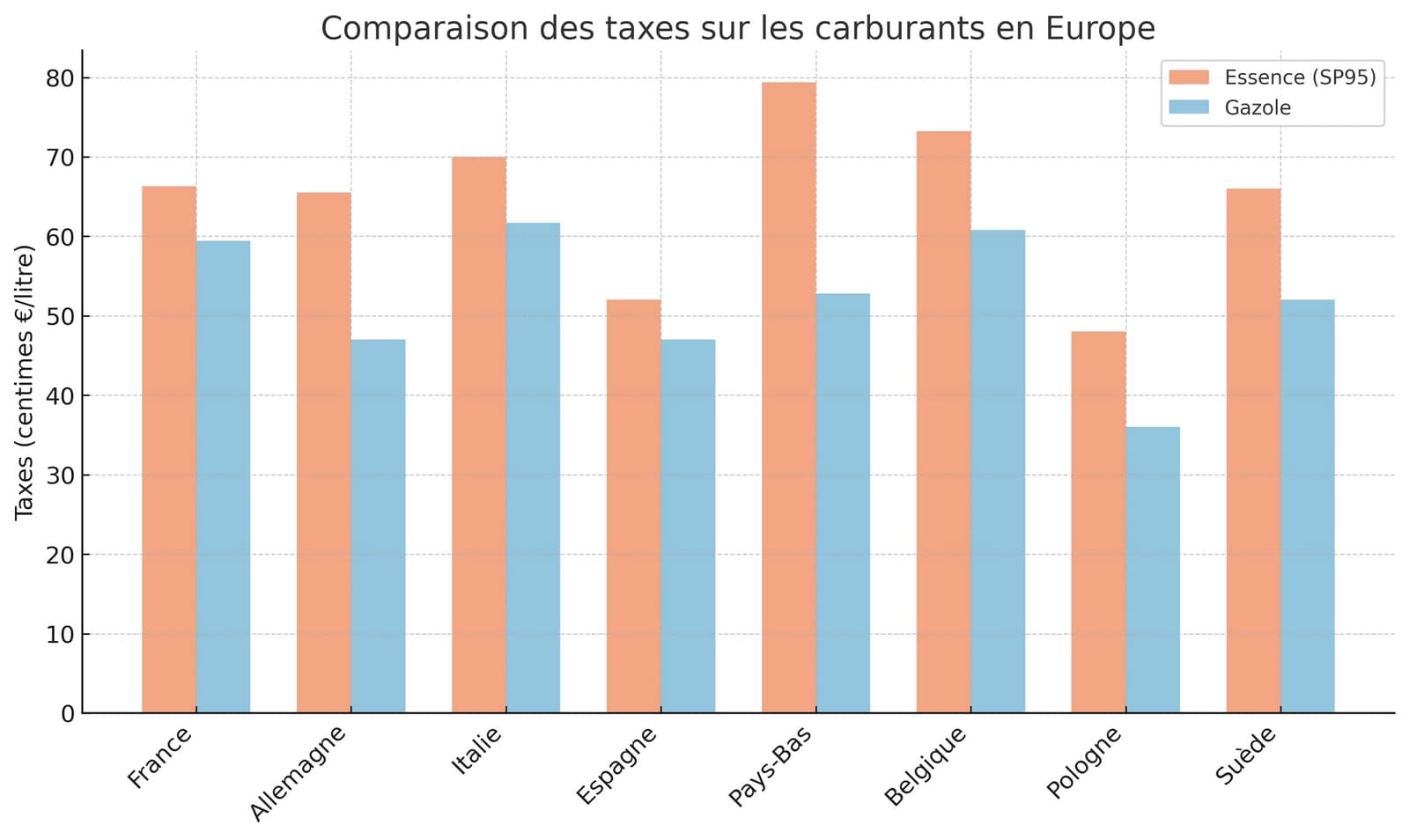

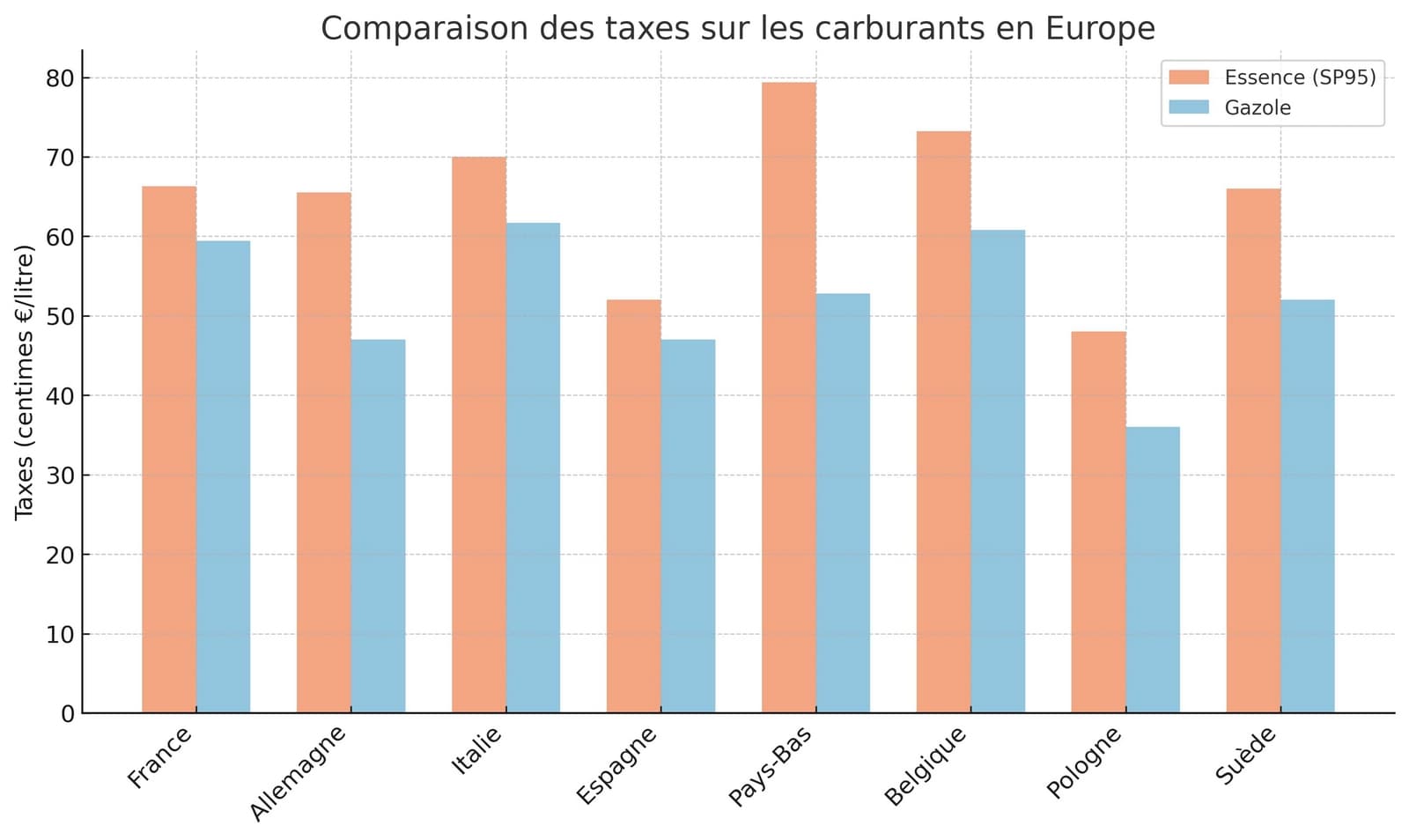

Comparison of Fuel Taxes in Europe

The price of motor fuels at the pump varies widely across European countries, mainly due to differences in taxation. The table below shows the taxes applied to gasoline (SP95) and diesel in various European countries, expressed in euros per litre, as well as the percentage those taxes represent in the total fuel price:

Comparative table of fuel taxes in Europe

| Country | Gasoline (SP95): Taxes €/L | Gasoline: % of price | Diesel: Taxes €/L | Diesel: % of price |

|---|---|---|---|---|

| Netherlands | 0.789 | 64.5% | 0.528 | 56.2% |

| Italy | 0.728 | 62.0% | 0.617 | 58.3% |

| Finland | 0.720 | 61.5% | 0.530 | 55.0% |

| Greece | 0.700 | 60.0% | 0.410 | 50.5% |

| Denmark | 0.683 | 59.8% | 0.475 | 53.5% |

| France | 0.682 | 59.5% | 0.594 | 57.0% |

| Germany | 0.655 | 58.0% | 0.470 | 52.0% |

| Belgium | 0.600 | 55.0% | 0.600 | 55.0% |

| Austria | 0.482 | 50.5% | 0.397 | 48.0% |

| Spain | 0.520 | 49.0% | 0.470 | 47.5% |

| Poland | 0.480 | 48.0% | 0.360 | 45.0% |

| Bulgaria | 0.363 | 46.0% | 0.330 | 44.0% |

Analysis

We observe that the Netherlands and Italy apply the highest taxes on gasoline, representing 64.5% and 62.0% of the total price respectively. For diesel, Italy and France are among the countries with the highest tax shares, at 58.3% and 57.0% respectively.

Conversely, countries such as Bulgaria and Poland show lower taxation levels, with gasoline taxes accounting for 46.0% and 48.0% of the total price respectively.

These significant differences in fuel taxation within the European Union reflect each country’s specific policy and economic choices. They directly affect pump prices and can influence consumers’ fueling behaviour.

For a more detailed view, see the chart below:

Commentaire

Aucun commentaire pour l’instant. Soyez le premier à réagir !